Say goodbye to the login shuffle

AbbyBank's Personal Finance tool brings all your financial info under one roof, making money management a breeze. There is no need to sign into all your separate financial accounts (internal and external) and online payment portals. With this free real-time aggregation tool available in eBanking and Mobile Banking, you can control your money on one screen with technology you can trust. It's a great way to track your spending, investments, budgets, goals and income.

Connect Accounts

Your money in a 360-degree view.

See all your internal and external accounts from multiple financial institutions, including your credit cards and investments, in one place. Manage the account name, account type, interest rate, credit limit, original balance, account purpose, alerts, and historical balance.

See all your internal and external accounts from multiple financial institutions, including your credit cards and investments, in one place. Manage the account name, account type, interest rate, credit limit, original balance, account purpose, alerts, and historical balance.

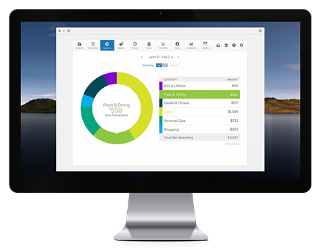

Budgets

Get the answers you need to make financial decisions.

Visualize your spending over time divided into categories. You'll be able to create custom budget categories, adjust the amount allocated for the budget, view historical budgets, and change projected income. You can use bubbles (circles) or the traditional bar to display your budgets.

Visualize your spending over time divided into categories. You'll be able to create custom budget categories, adjust the amount allocated for the budget, view historical budgets, and change projected income. You can use bubbles (circles) or the traditional bar to display your budgets.

Subscriptions & Expense Tracking

Understand how you spend your money.

Personal Finance automatically categorizes your spending, so you can better track all your expenses from your accounts in one place. You'll know where your money is really going by seeing where, when and how you spend.

Personal Finance automatically categorizes your spending, so you can better track all your expenses from your accounts in one place. You'll know where your money is really going by seeing where, when and how you spend.

Get Started

- You must be an AbbyBank customer and have eBanking before you can utilize our Personal Finance tool.

- Login to your eBanking account and click on the "More" option, then click on "Personal Finance" in the submenu.

- If you have our Mobile app, simply login and you can access "Personal Finance" from the main screen or from the "More" menu option. From there, you can add external accounts to include other banking information (checking, savings, loans and credit cards), investments, insurance, properties, prepaid cards, cash, and more!

Personal Checking

Explore our Personal Checking accounts. With great options and useful services, we've got something for everyone.

Saving Solutions

Discover our Savings Accounts tailored to suit your financial goals.

Other services we think you might like

Common Questions

How can AbbyBank’s PFM tool help me manage finances?

When you know where you are spending your money, you can take control and change your spending habits faster. AbbyBank’s Personal Financial Management (PFM) tool allows you to aggregate all your financial data into one big picture. You can create budgets, visualize your net worth, manage debt, create financial goals, track subscriptions and view trends, spending and cash flow insights. You can also view historical budgets and change projected income as your financial situation changes.

What type of other bank accounts can be included in the PFM tool?

AbbyBank’s PFM tool offers financial data aggregation to allow you to view all your accounts in one place. You can connect internal AbbyBank accounts like a checking account or savings account. You can also connect external accounts using other banking information from checking, savings, loans, credit cards, investments, cryptocurrency, as well as other assets and liabilities.

Can I set and manage a personal budget using the PFM tool?

Yes, AbbyBank customers that have our online banking or mobile banking app can create a customized personal budget using the PFM tools. The budgeting tool provides visualization of spending habits over time. It is then divided into categories allocated for each specific budget. You can create custom budget categories and adjust the amount allocated for the categories. You can also view historical budgets and change projected income as needed. Your budgets can be viewed as bubbles or as a traditional bar chart.

AbbyBank is a full-service financial institution with Wisconsin locations in Abbotsford, Appleton, Gresham, Medford, Shawano, Wausau, Weston and Withee.